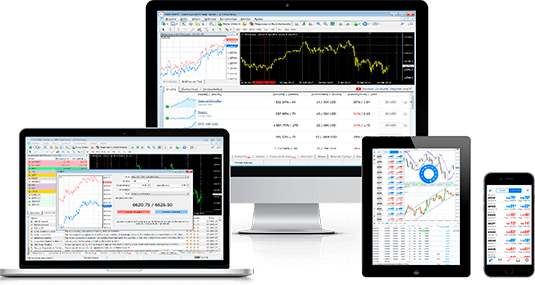

On the MT4 Platform, You can Trade on:

Indices

Trade the world’s most popular equity indices – view our indices list

Commodities

Buy gold, sell oil or maybe invest in coffee – all commodities here

Cryptocurrencies

Invest in Bitcoin, Tether, Litecoin or Etherum – discover all cryptocurrencies

Fast and Easy Deposits and Withdrawals with EXCO

More information about payment methods you will find on the deposit section.